Social Security is a federal benefits program designed to provide a source of income for retirees, and for those whose qualifying spouse has died. Most jobs deduct Social Security taxes from your paycheck, and your Social Security benefit is based on the number of years you’ve been working and the amount you’ve earned.

Social Security benefits are not intended to be your only source of retirement income. You may need other savings, investments, pensions, or retirement accounts to make sure you have enough money when you retire. (There are also Social Security benefits for people who cannot work due to a disability, but this article is primarily about Social Security as a source of income for retirees.)

Who is eligible for Social Security benefits?

You. You’re eligible for Social Security benefits if you’re 62 or older and have worked and paid Social Security taxes for 10 years or more. Some jobs — such as state and local government positions — don’t pay Social Security taxes and therefore don’t contribute to eligibility.

Your current or former spouse. Social Security benefits may be available to a spouse — even if they haven’t worked or paid Social Security taxes for 10 or more years — based on your marital status. The Social Security Administration (SSA) will factor in your work history and Social Security taxes to determine eligibility and the benefit.

According to the SSA, people who are in non-marital legal relationships like civil unions or domestic partnerships may be entitled to the same benefits as a married person.1

Your children. They may be eligible for a monthly benefit if they are unmarried and under the age of 18 (or if they are 18 or 19 years old and attend elementary or high school full time) and you are retired or disabled; they may also be eligible if they have a disability.

The SSA offers a helpful tool to determine eligibility for benefits.

Types of Social Security benefits

You can apply for Social Security online at ssa.gov/apply. There are four primary types of Social Security benefits:

- Retirement benefits are a monthly check that replaces part of your income when you reduce your hours or stop working altogether. Because it may not replace all your income, it is important to have a retirement plan.

- Social Security Disability Insurance (SSDI) pays benefits to you and certain family members if you worked long enough — and recently enough — and paid Social Security taxes on your earnings.

- Supplemental Security Income (SSI) is paid to eligible adults and children if they have little or no income, and little or no resources, and a disability, blindness, or are age 65 or older.

- Survivors benefits are paid to widows, widowers, and dependents of eligible workers.

Spousal vs. survivors benefits

Spousal benefits are available to spouses who are 62 or older who didn’t work or earn enough credits to qualify for Social Security on their own. The highest payment a spouse can receive is half the benefit their spouse is entitled to at their full retirement age.

Meanwhile, when a spouse dies, the surviving spouse is entitled to file for a survivors benefit as early as age 60. The benefit is reduced if the survivor files prior to reaching their full retirement age, and they can switch to their own Social Security benefits when they become eligible (through age 70) if their benefit is higher than the survivors benefit.

People who were married for 10 years or longer — and are divorced and have not remarried — may also qualify for the spousal benefit and the survivors benefit.

When to apply

You should apply for Social Security benefits approximately three months before your retirement date.

How are Social Security benefits calculated?

Your Social Security benefit is calculated using average indexed monthly earnings (AIME) for up to 35 years of your earnings. This average is then used to determine the primary insurance amount (PIA), which is the basis for your benefits.

To calculate the PIA, the SSA determines the three portions of AIME that will be used in the calculation. (These ranges help ensure that benefits are distributed fairly among the nation’s workers.)

For a person who first becomes eligible for Social Security benefits in 2024, the PIA formula is:

- 90% of the first $1,174 of AIME

- 32% of AIME over $1,174 and through $7,078

- 15% of AIME over $7,078.

For example, here’s how Social Security benefits would be calculated using the PIA and a hypothetical AIME of $5,000 for a worker retiring at full retirement age in 2024:

- 90% of the first $1,174 of AIME = $1,056.60

- 32% of AIME over $1,174 and through $7,078 = $1,941.12

- 15% of AIME over $7,708 = $0

Therefore, the worker’s PIA is $2,997.70. (The amount is rounded down to the nearest ten cents.)

How do I find out my Social Security benefit amount?

You can check your Social Security account to see your benefit amount. Your online Social Security statement provides secure, convenient access to estimates for retirement, disability, and survivors benefits. You can easily set up your personal Social Security account at ssa.gov/myaccount.

To keep up with inflation, benefits are adjusted through cost-of-living adjustments.

What is the full retirement age for Social Security?

Your full retirement age is a point in time between age 66 and 67, which is used by the SSA to determine your benefit amount, as well as your family’s benefits. No matter what your full retirement age is, your payment will be higher the longer you wait to apply, up until age 70.

Social Security retirement age chart

| Your Birth Year |

Your Full Retirement Age |

| 1943-1954 |

66 |

| 1955 |

66 and two months |

| 1956 |

66 and four months |

| 1957 |

66 and six months |

| 1958 |

66 and eight months |

| 1959 |

66 and ten months |

| 1960 |

67 |

If you were born on January 1, refer to the previous year to determine your full retirement age.1

Taking Social Security early

You can begin receiving Social Security benefits before your full retirement age, as early as age 62 — but if you start early, your benefit will be less than if you wait until your full retirement age. Your benefit will be reduced by 5/9 of 1% for every month between your retirement date and your full retirement age, up to 36 months, then by 5/12 of 1% thereafter. This reduction is permanent — you won’t be eligible for a benefit increase once you reach full retirement age.

Even though your monthly benefit will be less, you might receive the same or more total lifetime benefits as you would if you waited until full retirement age. That’s because even though you’ll receive less per month, you might receive benefits over a longer period of time.

The same logic applies if you delay your retirement benefits past your full retirement age. Your benefit will permanently increase by a certain percentage, up to the maximum age of 70. For anyone born in 1943 or later, the monthly percentage is 2/3 of 1%, or an annual percentage of 8%.

The following chart shows how much a monthly benefit of $2,000 taken at a full retirement age of 67 would be worth if taken earlier or later than full retirement age. For example, as this chart shows, this $2,000 benefit would be worth $1,400 if taken at age 62, and $2,480 if taken at age 70.

This hypothetical illustration is based on Social Security Administration rules. Actual results will vary.

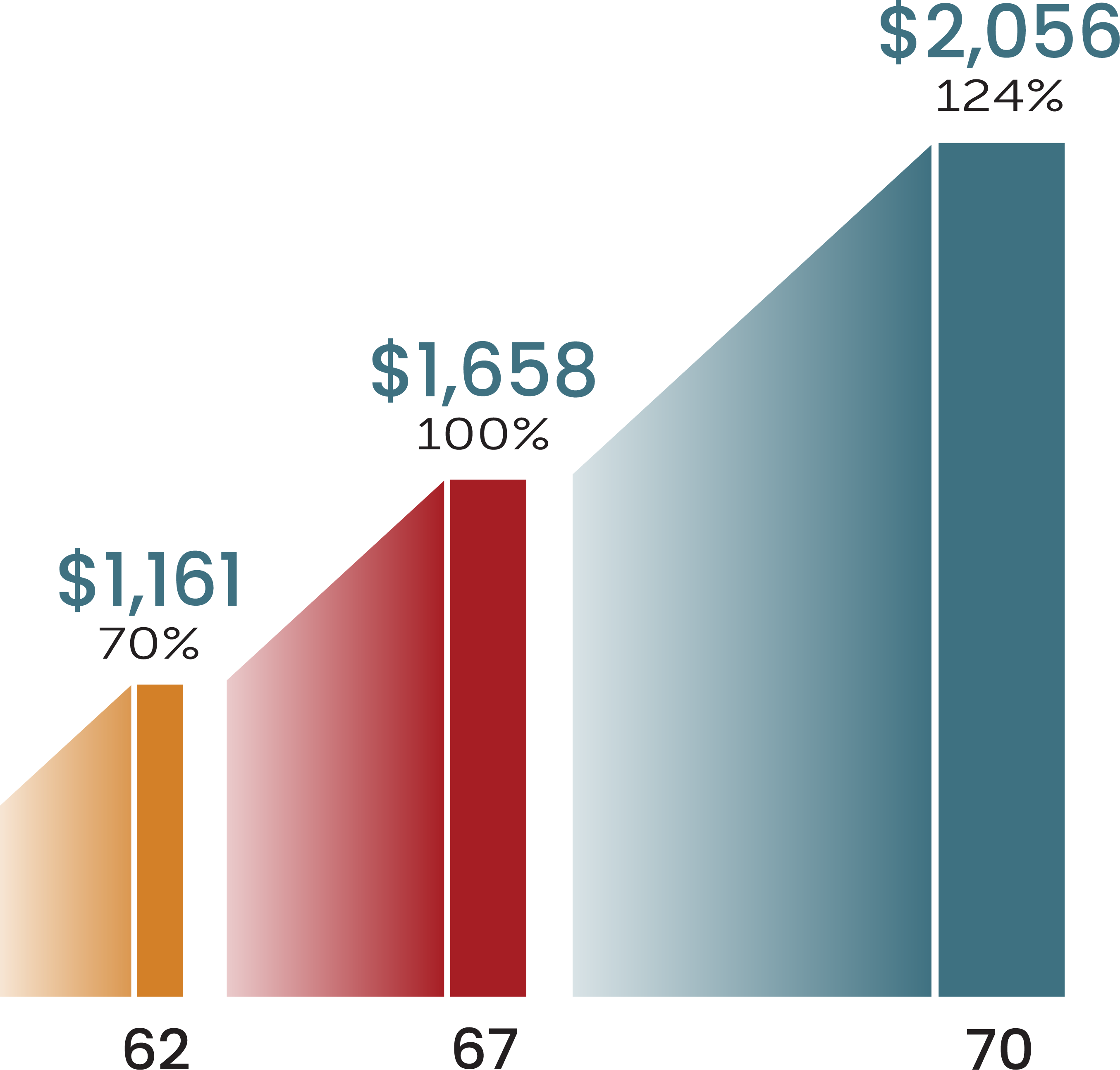

The example above uses the average benefit amount for 2022. For a person whose full retirement age (FRA) is 67, it shows the cost of waiting and the benefit of waiting. (This is sample data for illustrative purposes only. Each person’s monthly benefit will vary based on birth year, work history, and other factors.)

Are Social Security benefits taxable?

Roughly 40% of people who receive Social Security must pay federal income taxes2 on their benefits. This usually happens if you’re earning other substantial income — including wages, earnings from self-employment, interest, dividends, and other taxable income that must be reported on your tax return — in addition to your benefits.

According to the SSA, you need to pay taxes on up to 85% of your Social Security benefits if you:

- file an individual federal tax return and your combined income is

- between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits, or

- more than $34,000, up to 85% of your benefits may be taxable.

- file a joint return with a combined income that is

- between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits, or

- more than $44,000, up to 85% of your benefits may be taxable.

- are married and file a separate tax return, you will probably pay taxes on your benefits.

You can work and collect Social Security benefits at the same time, but there is an annual earnings limit to how much you can earn and still receive benefits if you’re under full retirement age. (In 2023, that limit was $21,240.) Once you’ve reached your full retirement age, there is no limit on how much you can earn and still receive benefits.

To set yourself up for a successful retirement, it’s important to work with a financial advisor to better understand your retirement income and to develop a retirement plan. Patelco members have complimentary access to a CFS3 Financial Advisor consultation. Learn how to reach your retirement goals — schedule your financial advisor consultation today.