1 APY=Annual Percentage Yield. Rates are effective as of 03/01/2025 and are subject to change before or after account opening without notice. Rates vary by tier and apply to the full balance.

The following variable interest rates will apply to your account balance: 4.00% APY on balances of $250,000.00 or greater, 4.00% APY on balances between $100,000.00 and $249,999.99, 3.51% APY on balances between $50,000.00 and $99,999.99, 3.00% APY on balances up to $49,999.99.

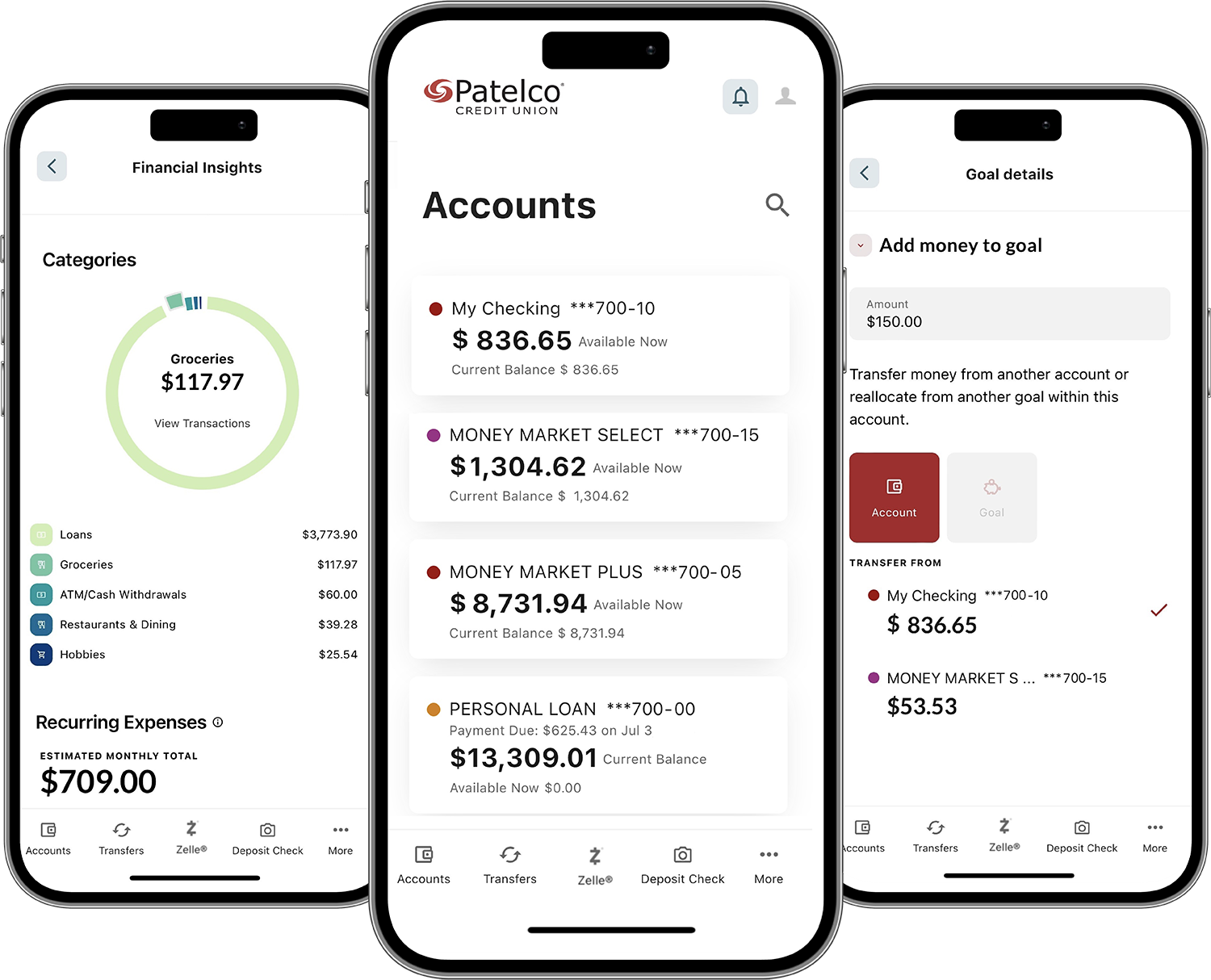

In order to attain higher interest rates the account must meet the eligibility requirements, that is a Patelco checking account (opened under the same Member Number) with a total monthly deposit of $500 or more. If the account fails to meet eligibility, the lower interest rate of 0.05% APY will be defaulted. Qualifying deposit transactions include: Payroll direct deposits, Social Security (or other government benefit) direct deposits, ACH transfers, Zelle®, Venmo, PayPal or other similar deposits, cash deposits, check deposits (except checks written from another Patelco account), wire transfers, multiple deposits (of the types listed above) that add up to at least $500 in a calendar month. Qualifying deposit transactions do not include Patelco account-to-Patelco account transfers, chargebacks or promotional incentive payments from Patelco.

For more details, read our Money Market Plus Account Overview.

* Rate at 3.96x California Average: Data from Informa rates as of 02/26/2025 on balances of $250,000.